Change is the only constant in life, and financial management apps are no exception. Recently, we found ourselves in the midst of a significant change as Mint, our trusted companion in budgeting and financial planning for years, announced its shutdown. Faced with the need to find a suitable alternative, we carefully evaluated our options and ultimately decided to make the switch to Monarch Money. Curious why we made the switch? We’re going to delve into the reasons behind our choice, highlighting the pros and cons of Monarch Money as we bid farewell to Mint.

What We Love About Monarch Money

- User-Friendly Interface: Monarch Money boasts a clean and intuitive user interface that makes managing finances a breeze. The dashboard is well-organized, providing a comprehensive overview of your financial landscape without overwhelming you with unnecessary details.

- Trusted Leadership: Monarch Money was started by a former Mint Executive! We feel like it has the same heart and soul we loved about Mint.

- Advanced Security Measures: Security is a top priority when it comes to handling sensitive financial information. Monarch Money impressed us with its robust security features, including end-to-end encryption, two-factor authentication, and other advanced measures that ensure our data remains secure.

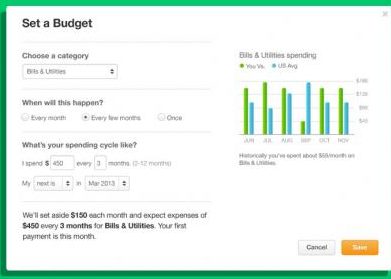

- Customizable Budgeting Tools: Monarch Money understands that everyone’s financial journey is unique. The app offers highly customizable budgeting tools, allowing users to tailor their budgets to their specific needs and financial goals. This level of flexibility was a significant factor in our decision-making process.

- Cryptocurrency Integration: As the financial landscape evolves, so do our needs. Monarch Money goes beyond traditional financial tracking by seamlessly integrating cryptocurrency accounts. This forward-thinking approach aligns with the growing interest in digital assets, providing a more holistic view of our financial portfolio.

- Automated Expense Tracking: Monarch Money’s automated expense tracking feature streamlines the process of categorizing and analyzing expenditures. This not only saves time but also enhances accuracy in budget tracking, a crucial aspect of effective financial management.

The Challenges With Monarch Money

- Learning Curve: While Monarch Money’s interface is user-friendly, some users might experience a slight learning curve during the transition. The navigation and features may take some time to get accustomed to, but we picked them up pretty quick moving from Mint.

- Limited Historical Data Import: One drawback we encountered during the switch was losing some of our history from Mint. However, there is an amazing import feature the moves your info directly from Mint. Great feature of Monarch!

- Subscription Cost: Monarch Money operates on a subscription-based model, and while the cost is reasonable for the features offered, it may be a potential deterrent for users who are accustomed to free financial management apps like Mint.

In the face of Mint’s imminent shutdown, the decision to transition to Monarch Money is one we feel good about! The pros, including a user-friendly interface, advanced security, customizable budgeting tools, cryptocurrency integration, and automated expense tracking, outweighed the cons in our assessment. While there may be a slight learning curve, the overall value and innovative features offered by Monarch Money aligned with our evolving financial needs.

As we embark on this new chapter with Monarch Money, we look forward to exploring its full potential and adapting to the changes in our financial management routine. Change may be inevitable, but with the right tools, it can also be an opportunity for growth and improvement.

Want to give Monarch Money a try? Get an extended 30-day free trial if you sign up with our referral link! We think you’ll like it for the same reasons we do!