As Mother’s Day approaches, you may be finding yourself scrambling to find the perfect gift to show our appreciation for the amazing mom (or moms!) in your life. However, you don’t have to spend a lot of money on gifts to show mom you care. That’s why we’ve compiled a list of low-cost gift ideas that will make your mom smile without breaking the bank.

Why Low Cost Gifts Matter

While it’s easy to think that the cost of a gift is proportional to how much you care, that’s not always the case. Sometimes, the most thoughtful and meaningful gifts are the ones that cost very little. In fact, a low-cost gift can be even more special because it shows that you put thought and effort into finding something that your mom would love, even on a tight budget.

Additionally, with the current economic climate, many families may not have the financial means to spend a lot of money on gifts. By choosing a low-cost gift, you can still show your mom how much you care without adding to any financial stress.

Budget-Friendly Mother’s Day Gift Ideas

Although it may seem like you need to spend a lot to show mom you care, we’re pretty sure no mom wants you to go into debt or break your money saving goals to celebrate her. In fact, there are many ways you can show mom you care regardless of budget. Need a little inspiration? From thoughtful, no-cost gifts to a few of our favorite ideas costing $30 or less, we’ve got your back this Mother’s Day season.

DIY Mother’s Day Gifts

- Homemade coupon book: Create a personalized coupon book filled with things like breakfast in bed, a day of cleaning, or a special movie night that mom can “cash in” whenever she’d like.

- Hand-painted vase: Purchase a cheap glass vase and use acrylic paints to create a one-of-a-kind design.

- Handwritten recipe book: Collect your family’s favorite recipes and handwrite them into a notebook or recipe card set for your mom to cherish.

Thoughtful Yet Inexpensive Mother’s Day Gifts

- Handwritten letter: Write a heartfelt letter to your mom expressing your love and gratitude.

- Virtual experience: Plan a virtual movie or game night with your mom to spend quality time together, even if you can’t be in the same place.

- Charitable donation: Make a donation to a charity that your mom cares about in her name.

Mother’s Day Gifts Under $30

If you have a bit more wiggle room in your budget, consider these gift ideas under $30:

- Tea sampler: For the tea-loving mom, purchase a sampler set of loose-leaf teas for her to enjoy.

- A beautiful puzzle: For the mom who loves to problem-solve, purchase a beautiful puzzle for her to work on. There are many gorgeous artworks to choose from these days, so you are sure to find one that she’ll love.

Mother’s Day Gifts Under $20

For those on an even tighter budget, these gifts under $20 are sure to make your mom feel loved:

- A candle featuring mom’s favorite scent: Let your mom create her own personal oasis with a gorgeous candle that features her favorite scent! Many can be found for under or around $20, like this one from Voluspa.

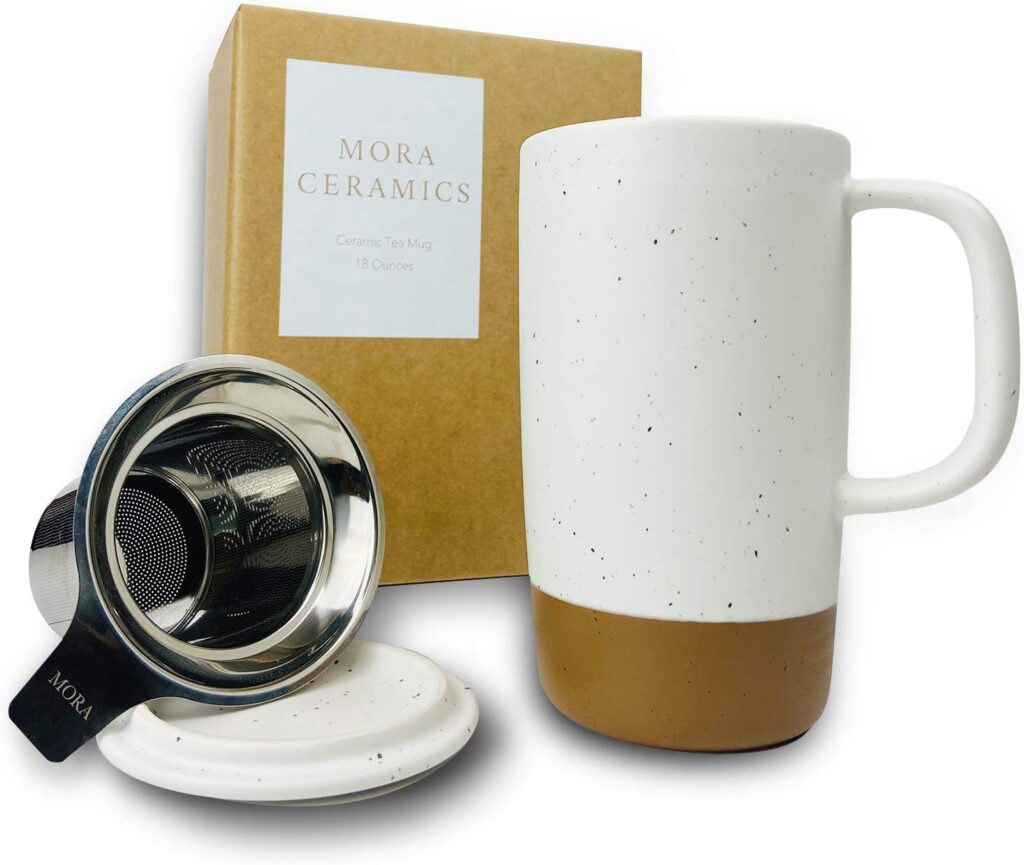

- Portable Coffee or Tea Mug: Whether you get mom the tea sampler as mentioned above OR just this mug, what we love about it is its flexibility. It comes with everything you need for coffee or tea and can keep mom caffeinated all morning long.

Mother’s Day Gifts Under $10

Believe it or not, you can still find meaningful gifts for your mom under $10. Consider these options:

- Bath bomb set: Purchase a set of bath bombs for a relaxing and indulgent gift.

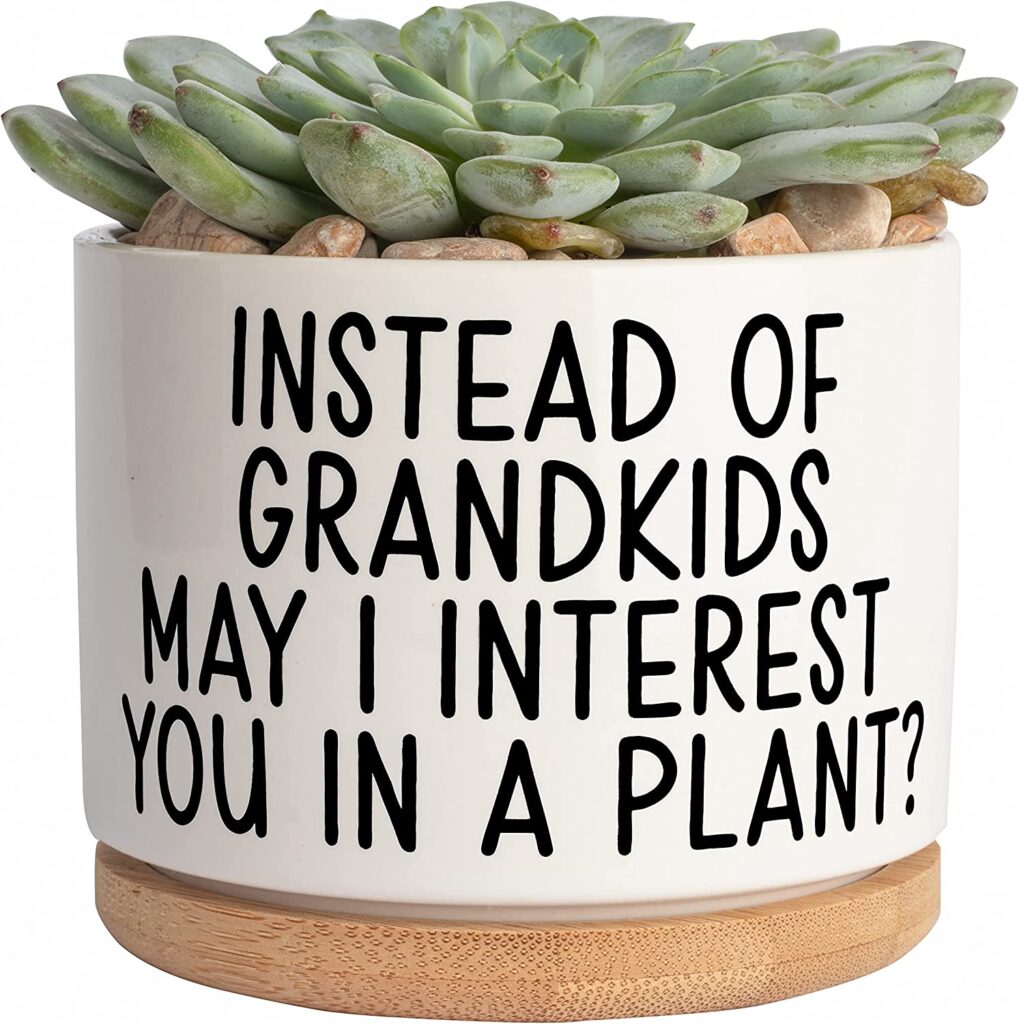

- Succulent plant: A small succulent plant is a great way to add some greenery to your mom’s space without spending a lot of money. Plus, you might find a funny succulent plant pot like this one below for under $10 as well!

Free Mother’s Day Gift Ideas

Sometimes, the best gifts are the ones that don’t cost anything at all. Here are a few ideas for free Mother’s Day gifts:

- Quality time: Plan a day of activities with your mom, such as a hike or picnic.

- Acts of service: Offer to do chores or run errands for your mom to give her a break.

- Homemade meal: Cook your mom’s favorite meal or bake her favorite dessert.

- Words of affirmation: Consider writing a poem or creating a homemade card to tell mom how much you love her. If you have little ones, this can be a great way for them to get in on the gift giving as well.

How to Make the Most of Your Gift on Mother’s Day

No matter what gift you choose, there are a few things you can do to make sure your mom feels extra special on Mother’s Day:

- Add a personal touch: Include a handwritten note to make your gift feel extra thoughtful.

- Spend quality time: Whether in person or virtually, make time to spend with your mom on Mother’s Day to show her how much you care.

- Show your appreciation: Make sure to express your gratitude and appreciation for all that your mom does for you.

Wrap Up Your Gift With Love

No matter what gift you choose, remember that the most important thing is to show your mom how much you love and appreciate her. With these low-cost gift ideas, you can make your mom smile without spending a fortune.

Conclusion

Mother’s Day is a special time to celebrate the amazing mothers in our lives. While it’s easy to get caught up in the commercialism of the holiday, remember that the most meaningful gifts are often the ones that cost very little. By choosing a low-cost gift and adding a personal touch, you can show your mom how much you care without adding to any financial stress. Happy Mother’s Day!