Understanding how to budget isn’t something we’re all necessarily familiar with. But with a few simple steps, you can get started and begin to change your financial future.

A few years ago we were lost. We had just started a business and suddenly found our bank account hitting rock bottom more often than we’d like to admit. When we both had steady paychecks, we tried not to spend frivolously. But if there was money in the account we figured that was a green light to spend at the local department store. Then we had to learn to live on less. After receiving another Non-Sufficient Funds announcement we decided to stop and assess where we were and how much we had to live on.

Related: Meet the Duo

So we started to track what we were spending. And an amazing thing happened. We had more control over what we spent when we made a decision before the money came how we were going to spend it. We found out that we could live on way less than we had been living on before things were tight with our start up.

Since that time there have been periods where we’ve had plenty financially and periods when things have been tight again, but we’ve always had a plan and have been blessed to not have to deal with an empty bank account.

Saving money isn’t rocket science. If you spend less than you make, you’ll come out ahead. But it doesn’t feel easy, especially at first.

Here are a few tips on how to get started in this area.

Watch your money.

A great first step is getting to know where your money is going. If you aren’t already, track your expenses for a month and determine your spending habits. There may be some things that surprise you. Like maybe those small stops for coffee are adding up to a big total at the end of the month. You can use a spreadsheet or there are a variety of different programs that can help.

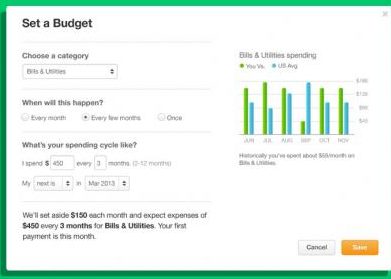

We use a free app we love called Mint (mint.com). You simply login to all your financial services and it will help you track your expenses and keep up with how you’re doing. It will also create charts and graphs to help you visualize.

We use a free app we love called Mint (mint.com). You simply login to all your financial services and it will help you track your expenses and keep up with how you’re doing. It will also create charts and graphs to help you visualize.

Determine your expenses.

Go through your monthly expenses and figure out what your recurring expenses are. They probably include things like a mortgage payment or rent, phone bills, groceries, etc. Make a list and determine how much each one costs each month.

Now determine which are discretionary and which are mandatory. Mandatory expenses are bills you know you have each month and don’t change. Like a rent payment or student loan. These are easier to plan for because they are always the same.

Discretionary expenses have a bit more flexibility in that they are not a set amount. Like groceries or gas. These are also the areas that you may be able to find savings if you change your habits. However, discretionary doesn’t mean they’re not important. You have to eat and have an ability to travel. But usually there’s flexibility in how you spend in each area.

Items that are discretionary and not required for you to live are things you should consider keeping, adjusting, or cutting from your budget.

When we got serious about our budget, we ended up cutting cable TV and just using streaming services like Netflix. The result was us saving over $100 per month and there were only a few shows we missed at first. But after a short while, we got over it and have never looked back.

Calculate your income.

Now go through all your sources of income. For some this is pretty simple, especially if you are only drawing income from a single job. For others, you may have money coming in from different sources at different times. Track it and make a conservative estimate of your monthly income for the purposes of your budget.

If you find there is not enough coming in to meet your expenses, you should evaluate if there are additional places you can make money.

Is there a side hustle you can work on the side to make a little extra to apply toward your expenses or a financial goal? If you feel stuck professionally, do you have a plan for the future to get more training or experience for a promotion or to take a step in a new direction.

Put it all together.

Once you have your budget, start tracking your spending. Make sure your budget is realistic so you can stay within the limits. When you’re first getting started you will likely need to tweak amounts in different areas. When you hit the amount you budgeted for any particular area, you can’t spend any more until next month.

Related: Five Ways to Stop Spending and Start Saving Money Today

The power of a budget is that you are making your money do what you planned for, not making you a subject to your every impulse and whim. But it loses it’s power if you don’t work to stay within the parameters you set.

We don’t get it perfect every month, but we get it right way more than we used to by accident. How have you done with budgeting in the past? Do you have a plan?