Receiving unexpected money, especially a tax refund or credit, can be an excellent opportunity to improve your financial situation or treat yourself. If you qualified for the Earned Income Tax Credit (EITC) in Michigan for the tax year 2022, you may be eligible to receive a $550 check. While it might be tempting to splurge on something fun, there are strategic ways to utilize this money that can benefit you in the long run. Let’s explore some of the best ways to make the most out of your $550 EITC check in Michigan.

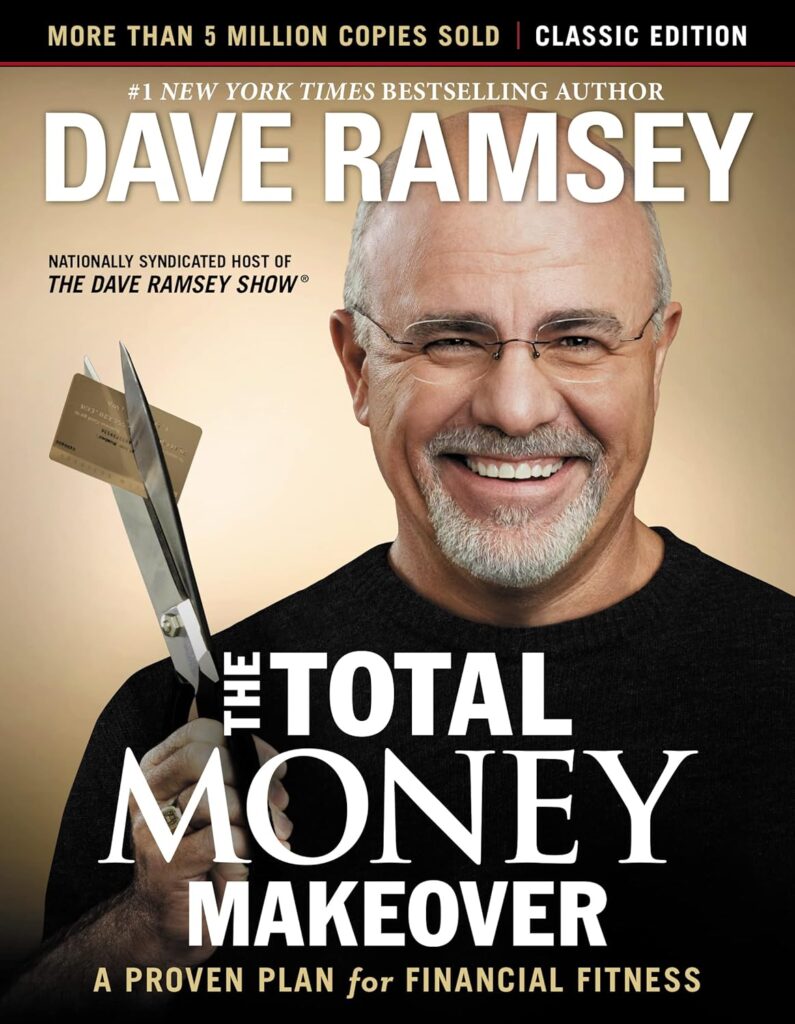

Debt Repayment

One of the most prudent uses of unexpected funds is to pay off outstanding debts. Whether it’s credit card debt, personal loans, or medical bills, reducing your debt burden can significantly improve your financial well-being. Consider using a portion of your $550 check to tackle high-interest debts first, as this can save you money on interest payments over time.

Emergency Fund

Building or bolstering an emergency fund is crucial for financial stability. Aim to set aside enough money to cover at least three to six months’ worth of essential living expenses. If you don’t already have an emergency fund, consider using a portion of your EITC check to start one. Having this financial cushion can provide peace of mind and protect you from unexpected expenses or emergencies.

A high yield savings account can be a great place to stash your emergency fund dollars. Not only will they be easily accessible here if you need them, but you can make money through the interest you’ll earn while your money is set aside. We use Wealthfront for our short-term savings and currently earn 5% APY. Sign up for a Wealthfront Cash Account through our referral link and we’ll both get an EXTRA +0.50% boost for three months.

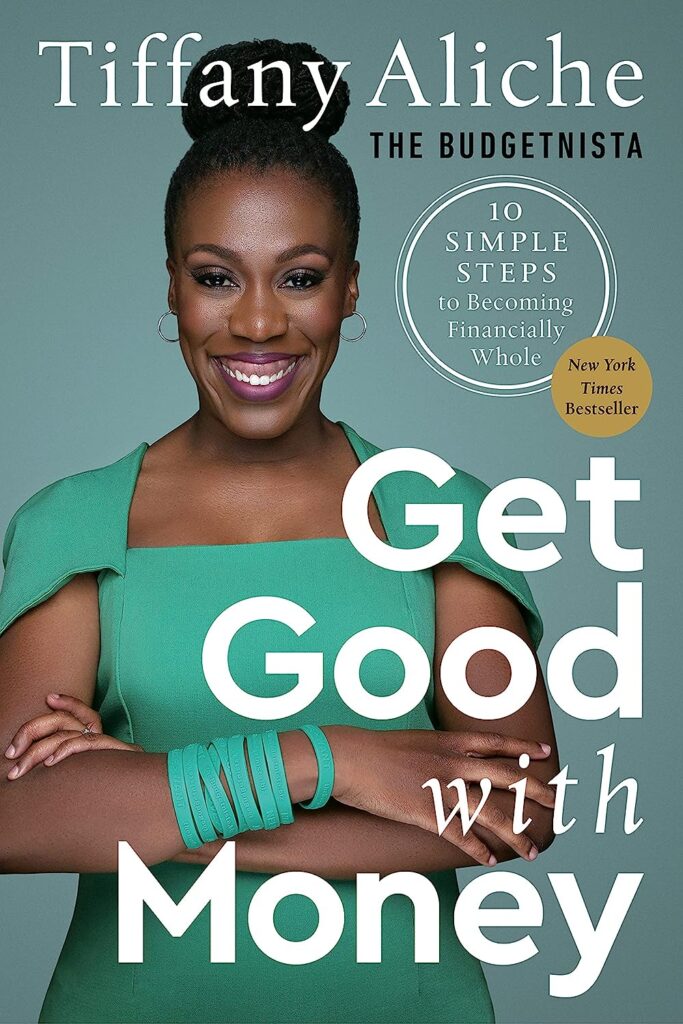

Invest in Education or Training

Investing in yourself can lead to long-term financial benefits. Use your $550 check to enroll in a course, workshop, or training program that can enhance your skills and qualifications. Whether it’s advancing in your current career or exploring new opportunities, investing in education can open doors to higher-paying jobs and increased earning potential in the future.

Home Repairs or Upgrades

If you’re a homeowner, consider using your EITC check to make necessary repairs or upgrades to your property. Investing in home improvements not only enhances your living environment but can also increase the value of your home over time. Focus on projects that offer the best return on investment, such as energy-efficient upgrades or essential maintenance. These types of investments will continue to help you save even more money.

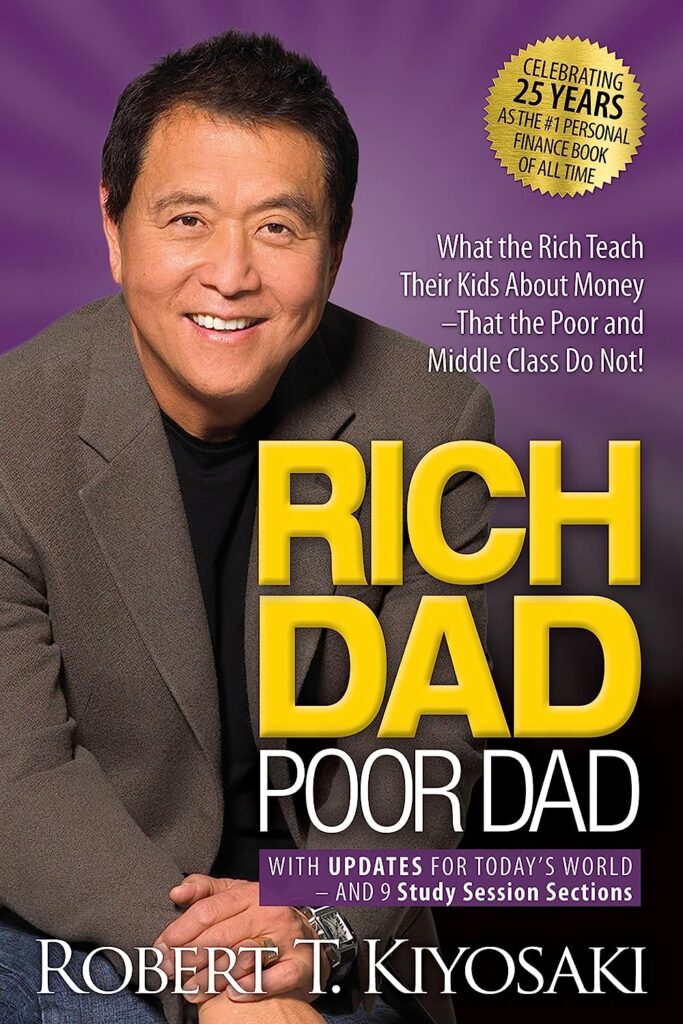

Save for Future Goals

If you’ve already addressed debt, built an emergency fund, and covered immediate needs, consider saving your $550 EITC check for future goals. Whether it’s saving for a down payment on a home, funding your child’s education, or planning for retirement, having savings set aside can help you achieve your long-term financial objectives.

16 Best IRA Accounts of February 2024

Receiving a $550 check as part of the Earned Income Tax Credit in Michigan presents a valuable opportunity to improve your financial situation. By using this money wisely, you can make meaningful strides toward financial stability and long-term prosperity. Whether you choose to pay off debt, build an emergency fund, invest in education, make home improvements, or save for future goals, thoughtful planning and strategic decision-making can maximize the impact of your EITC check. Take advantage of this opportunity to secure your financial future and achieve your financial goals.